The Immigration Issue in Libertarianism

Primary tabs

By Per Bylund - September 18, 2018

Over a decade ago, I wrote an article published at Mises.org on the libertarian immigration conundrum. The “conundrum” was the seemingly unbridgeable differences between, if not contradictory views of, the two libertarian answers to the immigration question. The point of the article was to show that these answers are more compatible than most libertarians tend to think; both, in fact, espouse the non-aggression principle, but they emphasize different aspects of it.

Since then, however, the debate has become more polarized and it has more or less caused a rift within the libertarian movement.

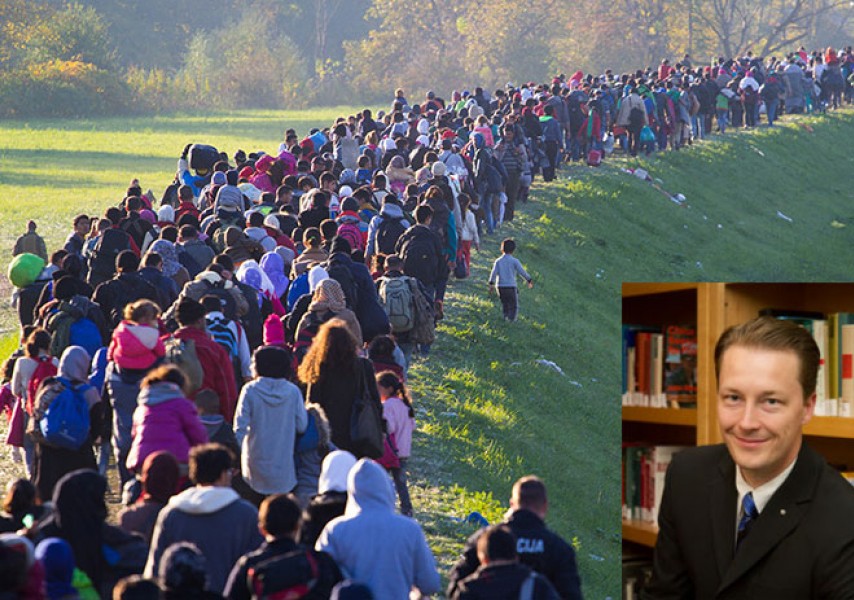

The two libertarian positions on immigration, put simply, are the classical libertarian position of “open borders” (“no borders” might be more accurate) and the more recent “cost-principle” or “property-rights” view, primarily seen in the works of Hans-Hermann Hoppe. The latter has over the past few years, at least partially as a reaction to the “mass immigration” crisis in Europe, gained a rather large following and, as a result, the debate has intensified. (Hoppe’s argument has also, in a twisted turn, legitimized the highly statist so-called “alt-right” movement, which strangely appears to have attracted many libertarians.)

Utopia versus realpolitik

The differences between the two positions is not about what a libertarian world would be like. Such a beautiful world would have no governments, so the issue of migration would purely be a matter of how owners of property, whether private or joint/collective, choose to use it. Migration is then a matter of buying property or getting permission by current owners to enter and reside on their land; movement would not be restricted, but use of another’s property would be. Such a world actually has none of the problems these two views try to solve. The conflict is instead one about how the libertarian non-aggression principle applies pragmatically in the world as-is. That is, in a world of States.

Simply put, the open borders argument states that governments have no right to restrict or in any other sense meddle with people’s choices to migrate. Thus, enforcement of borders, which are the territorial limits to a State’s power, is illegitimate. Hoppeans, on the other hand, argue that the government has no right to invite (or even subsidize) immigrants to a country, as this will always be at the expense of resident taxpayers – and thus a violation of their property rights.

Both are plausible arguments in line with the non-aggression principle. This is the reason there is a debate at all, and why libertarians can disagree on what is the “proper” position on immigration in a world of States.

The debate is lacking, however. While the Hoppean argument was and still is used (rightly) as a challenge and critique of the “open borders” argument, there is surprisingly little serious analysis of the reasoning behind the cost principle.

In this essay I attempt to address this gap, and what I consider to be a fundamental flaw in the Hoppean logic. While the argument is expressed in several of Hoppe’s (and others’) writings, which tend to emphasize different aspects, I will here focus on one specific essay: a recently published excerpt from a Hoppe speech, published at LewRockwell.com under the title Immigration and Libertarianism. (There will be reason to address other texts separately.)

The Hoppean argument

Hoppe rightly notes that in a libertarian world, immigration is a non-issue. Under global libertarianism, migration would be a matter of property rights. Or, as he puts it, “the immigration problem vanishes” as, with all land being privately (or collectively) owned, “There exists no right to immigration.”

While Hoppe uses this argument, which to my mind is true, as a way of raising doubts about the “open borders” position, I don’t see how any libertarian can argue against this. In a libertarian world, anyone who owns or contractually controls property has the right to invite and/or deny others to reside on that piece of property. It’s not a matter of nation-state borders. Hoppe is very clear on this, and notes that “A right to ‘free’ immigration exists only for virgin country, for the open frontier.” Indeed. Nobody has a right to somebody else’s just property.

Hoppe further points out that government property is illegitimate, which should also be something that all libertarians can agree on.

The problem arises as Hoppe claims the cost principle, that is that, at least logically, “government property is illegitimate because it is based on prior expropriations, [and so] it does not follow that it is un-owned and free-for-all. It has been funded through local, regional, national or federal tax payments, and it is the payers of these taxes, then, and no one else, who are the legitimate owners of all public property.”

His argument is that “open borders” libertarians disregard this fact: that residents have a just claim on so-called public property that foreigners/immigrants do not. Indeed, in Hoppe’s words, for immigration to be legit, “The cost of the community property funded by resident taxpayers should not rise or its quality fall on account of the presence of immigrants.” Anything else is to subsidize immigration by forcing the domestic population to pay the costs of non-invitee immigrants, who live at the expense of residents.

The problem I have with this argument, is the rather naïve (read: incorrect) view of the State’s aggression and the extent of its harm. Specifically, that a State’s power is limited to the people residing within its territorial boundaries. This is simply not true, and to see why we need to consider both the real cost of government (primarily in the form of taxation, as Hoppe mentions) and the indirect cost (in terms of lost opportunities) – neither of which are actually limited to only residents within the State-controlled territory.

Taxation and the State

In terms of income tax, there should be little argument that any State claims ownership over those people officially residing within the limits of its territorial boundaries. An American pays taxes on income to the US government(s), a Swede pays taxes on income to the Swedish government, and a German pays taxes on income to the German government. Where this is not the case, it is generally because a citizen of a country resides elsewhere, and thus it becomes an issue of specific tax treatises between States.

But income tax is not the only tax we pay. Plenty of taxes affect trade across borders, such as import and export taxes but also things like sales tax to the degree it applies to tourists or online trade. There are also tariffs, quotas, and other trade barriers specifically designed to harm “foreign” individuals and businesses over domestic. While these taxes are different for different countries and do not affect those who choose not to do business in that country or with domestic actors, this still raises serious questions to the “resident taxpayers” claim.

If “foreigners” (non-residents) choosing to trade with domestic actors are hit with specific punitive taxes, then it is simply not accurate to claim that those residing within a country have a unique claim to the State’s controlled “public property.” If we also add the implications of monetary policy, a favorite topic for Austro-libertarians, which causes inflation and affects investments and exchange rates, it should be clear that taxation, direct and indirect, certainly does not affect only those residing within a country (the US dollar should be a case in point).

In other words, any State does not only cause harm on its own residents, even though it can perhaps do so to a greater extent, and thus the “public property” in a country is not financed solely by those residing in that country.

Loss of opportunity and the State

A State’s power is not simply the outright theft that it engages in, however. The power can also be seen in the loss of opportunities due to State restrictions. For example, under the Prohibition there were a number of opportunities for value creation, specifically related to the production and sale of spirits, that were suppressed by the government. Those opportunities were lost.

While we tend to focus on the effect of regulations within a country, it is not true that the State only causes such harm on its “own” population. The very existence of borders, and their enforcement, suggests that non-residents are deprived of opportunities that would otherwise have been available.

For example, steel tariffs may mean greater profitability for domestic steel producers, but only at the expense of foreign producers who would otherwise have been able to benefit consumers in that country by offering steel at lower prices. A steel tariff, in other words, means restricted opportunities for both domestic consumers (or producers using steel as input) and foreign steel producers.

There are thus many opportunities that would otherwise have been available that simply remain unrealized, as I argue in my 2016 book The Seen, the Unseen, and the Unrealized, because the State imposes regulations. But such regulations are not limited to, and do not affect only actors within a State’s “protected” borders. They also affect non-residents – in fact, border “protection” is often used specifically with the intention to harm non-residents.

The extent of State power

If it is the case that any State does not only oppress residents within its territorial borders, but also steal from (tax) and limit the opportunities for non-residents, then the argument against immigration based on the cost of public property falls.

One can, of course, claim that it is a matter of degree, that those residing outside the territorial boundaries of any one State are less oppressed than those residing within the borders. That may be true, but then it no longer has to do with whether one is resident or not. As libertarians often note, the taxes paid and the extent to which opportunities are unrealized vary a lot among residents too. Surely one cannot say that a domestic tax consumer has a greater claim to public property in country than a foreign tax payer?

Libertarian collectivism

The problem with the Hoppean argument arises not because there is an error in seeing the State as a violator of (natural or traditional) property rights. On the contrary, the State by its very existence violates property rights, and that’s a reason libertarians must oppose the State. The problem is that the Hoppean analysis applies on the abstract, collective level of the nation-State – not the level of the individual.

There is, in fact, very little in terms of the State’s violations of just property rights that can be claimed about all people within a State’s realm that cannot also, and in some respects to an even greater extent, be claimed for people residing elsewhere. The State does not oppress all equally, and its harmful effects are not limited to those residing within its controlled territory.

To assume, as Hoppeans appear to do, that a State oppresses one collective (such as the nation or people) more than other collectives, is not a solution to the problem – it introduces problems. And it directly contradicts the methodological individualism that libertarians traditionally rely on.

Originally published at The Libertarian Institute. Translated and republished with the written permission from the author.

Per Bylund is an Assistant Professor of Entrepreneurship and Records-Johnston Professor of Free Enterprise in the School of Entrepreneurship at Oklahoma State University. He is an Associated Scholar with the Mises Institute as well as senior fellow at the Ludwig von Mises-institutet i Sverige. Per's Twitter @PerBylund